Connecticut employers are provided the opportunity to obtain a federal tax credit in exchange for hiring members of certain groups of workers who have faced significant discrimination and/or barriers to employment in the past. These tax credits and the requirements to obtain them are set forth in the Work Opportunity Tax Credit program administered by the Connecticut Department of Labor.

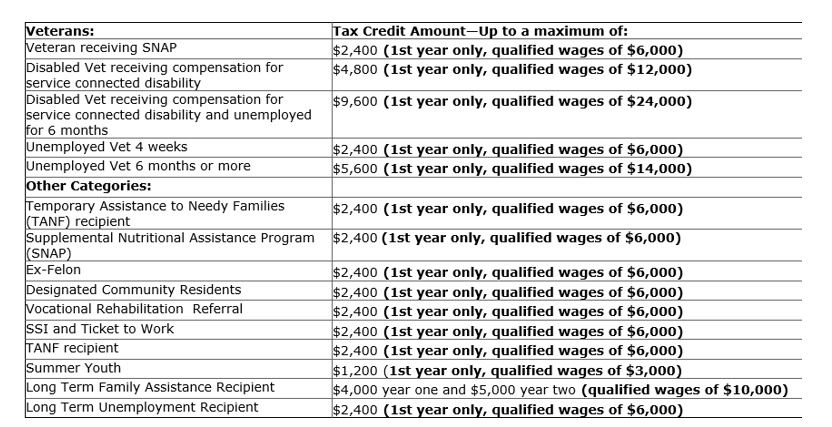

An employer engaged in this program may receive tax credits from $1,200 to $9,600 depending upon which identified group of eligible employees the employer hires. The one-time tax credits available to the employers are provided as the following as of 2020:

Credit to CT DOL- http://www.ctdol.state.ct.us/progsupt/taxcredits/taxcredit1.htm

Some important factors for consideration when an employer is seeking to take advantage of this program are that there is no limit on the number of people that the employer can hire under the Program and the tax credit is a direct deduction from the employer’s federal tax liability. However, the one-time tax credit is unavailable for rehires of the employer and can only apply to new employees. The Program also does not apply to employers not covered by the Federal Unemployment Tax Act as well as individuals who are relatives of the employer.

If you are an employer and are seeking assistance under the Work Opportunity Tax Credit Program, please contact the experienced employment lawyers at Harlow, Adams & Friedman, and P.C. today at 203-878-0661 for a free consultation.

Contact Us For a Free Consultation